The peril of overextended personal debt is often not a sudden plunge into financial chaos but a gradual, almost imperceptible descent fueled by a phen...

Read More

- Start by taking inventory of all your outstanding debts. - Look for ways to maximize your disposable income so you can put more money towards your ...

Read More

Navigating the vast landscape of credit card offers can feel like a daunting task, yet selecting the right one is a fundamental act of financial self-...

Read More

Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and...

Read More

The relationship between overextended personal debt and conspicuous consumption is a modern tragedy, where the pursuit of social validation through ma...

Read More

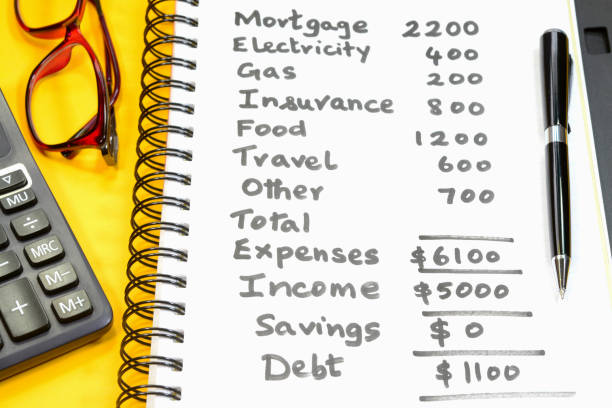

The crisis of overextended personal debt is rarely the result of a single poor decision. Instead, it is typically the culmination of several intersect...

Read MoreKey signs include: consistently making only minimum payments, using one credit card to pay another, frequently missing payment due dates, having a debt-to-income (DTI) ratio over 40%, and feeling constant stress or anxiety about money.

Yes, scoring models look at both your overall utilization across all cards and the utilization on each individual account. Maxing out a single card, even if others have low balances, can still hurt your score.

Once an unpaid bill is sent to a collection agency, it can be reported to credit bureaus, lowering your score and remaining on your report for up to 7 years.

Focus on: Account Balances and Credit Limits (to calculate utilization), Payment History (for any missed payments), Account Status (for charge-offs or collections), and Credit Inquiries (to see who has recently accessed your report).

The most common fee is a late payment fee, which can be substantial. While BNPL is often advertised as "interest-free," failing to make a payment on time can trigger these fees and, in some cases, lead to accruing interest after a missed payment.