The specter of overextended personal debt looms large in the modern economic landscape, a burden carried by millions. While often rationalized as a te...

Read More

The shadow of overextended personal debt casts a long and damaging pall over an individual’s financial identity, primarily embodied by their credit ...

Read More

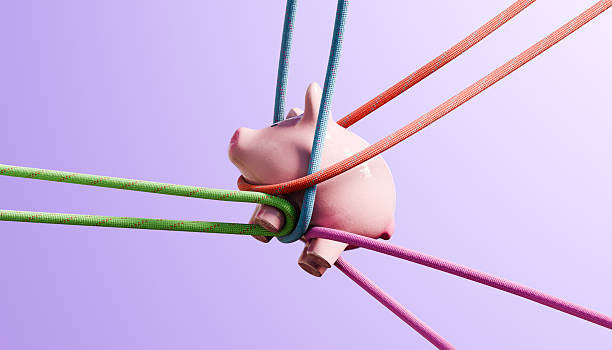

The crisis of overextended personal debt is a complex financial state where liabilities become unmanageable, and its profound impact on an individual‚...

Read More

Of all the factors that determine a credit score, the credit utilization ratio holds a unique and powerful position for those struggling with overexte...

Read More

The precarious state of overextended personal debt is often a private struggle until it triggers a series of formal and increasingly severe creditor a...

Read More

The precarious state of overextended personal debt often feels like a trap with no exit, a relentless cycle of high-interest payments that never seem ...

Read MoreYes. Programs like LIHEAP (Low Income Home Energy Assistance Program) provide financial aid for energy bills. Nonprofits and local community agencies may also offer help.

Track all your income and expenses for one month without judgment. This provides an honest snapshot of your spending habits and reveals areas where money is leaking out unnecessarily.

Focus on on-time payments, reduce credit utilization below 30%, avoid new credit applications, and maintain a mix of account types (e.g., credit cards, installment loans).

Maintaining on-time payments prevents costly late fees and penalty interest rates from being applied. This ensures more of your money goes toward reducing the principal balance rather than covering fees and higher interest charges.

Base your budget on your lowest expected monthly income. During higher-income months, allocate the extra funds directly to debt repayment or your emergency fund. This conservative approach prevents overspending.