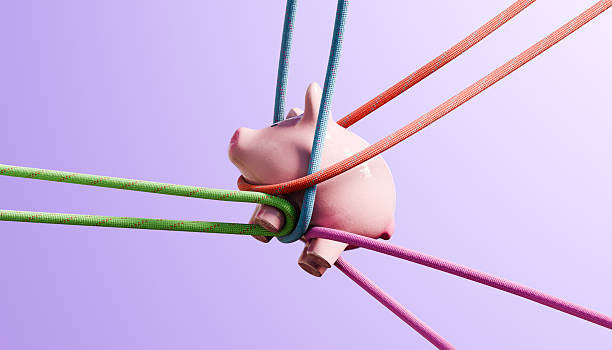

The precarious state of overextended personal debt is often a private struggle until it triggers a series of formal and increasingly severe creditor actions, transforming financial anxiety into tangible legal and economic consequences. This progression from reminder notices to potential litigation is a standardized process designed to compel repayment, and understanding its stages is crucial for any debtor navigating this challenging landscape. Initially, creditors respond to missed payments with persistent communications—letters, emails, and phone calls—that serve as urgent reminders. While stressful, this phase is primarily an attempt to negotiate a resolution before escalating matters.If these efforts fail, the account may be charged off by the original lender after approximately 180 days of delinquency. This accounting action, however, does not forgive the debt; instead, it is often sold to a third-party collection agency for a fraction of its value. This transfer marks a significant intensification, as collectors pursue the debt aggressively, frequently employing more persistent contact methods. Their goal is to secure any repayment, often through settlement offers. This stage is also critically damaging to one’s credit report, where the charged-off status and collection account remain for up to seven years, severely limiting access to new credit.The most severe creditor action involves litigation. A creditor or collector may file a lawsuit to obtain a court judgment against the debtor. If successful, this judgment empowers them to employ forceful collection tools such as wage garnishment, where a portion of the debtor’s paycheck is withheld directly by their employer, or levying funds from bank accounts. A lien may also be placed on property like a home or vehicle, complicating any attempt to sell or refinance the asset until the debt is satisfied. These actions represent the culmination of the collections process, moving beyond financial penalty to directly impinging on a debtor’s assets and income. Ultimately, the spectrum of creditor actions underscores the serious ramifications of unresolved debt, highlighting the imperative of proactive communication and seeking solutions like payment plans or credit counseling long before legal papers arrive.

The precarious state of overextended personal debt is often a private struggle until it triggers a series of formal and increasingly severe creditor actions, transforming financial anxiety into tangible legal and economic consequences. This progression from reminder notices to potential litigation is a standardized process designed to compel repayment, and understanding its stages is crucial for any debtor navigating this challenging landscape. Initially, creditors respond to missed payments with persistent communications—letters, emails, and phone calls—that serve as urgent reminders. While stressful, this phase is primarily an attempt to negotiate a resolution before escalating matters.If these efforts fail, the account may be charged off by the original lender after approximately 180 days of delinquency. This accounting action, however, does not forgive the debt; instead, it is often sold to a third-party collection agency for a fraction of its value. This transfer marks a significant intensification, as collectors pursue the debt aggressively, frequently employing more persistent contact methods. Their goal is to secure any repayment, often through settlement offers. This stage is also critically damaging to one’s credit report, where the charged-off status and collection account remain for up to seven years, severely limiting access to new credit.The most severe creditor action involves litigation. A creditor or collector may file a lawsuit to obtain a court judgment against the debtor. If successful, this judgment empowers them to employ forceful collection tools such as wage garnishment, where a portion of the debtor’s paycheck is withheld directly by their employer, or levying funds from bank accounts. A lien may also be placed on property like a home or vehicle, complicating any attempt to sell or refinance the asset until the debt is satisfied. These actions represent the culmination of the collections process, moving beyond financial penalty to directly impinging on a debtor’s assets and income. Ultimately, the spectrum of creditor actions underscores the serious ramifications of unresolved debt, highlighting the imperative of proactive communication and seeking solutions like payment plans or credit counseling long before legal papers arrive.

Different types of debt require different strategies. Prioritizing secured debts (e.g., avoiding homelessness) and high-interest debts (e.g., credit cards) is crucial, while some debts (e.g., medical) may have more flexible repayment or forgiveness options.

Every dollar spent on interest payments for emergency debt is a dollar not invested for retirement, saved for a home, or spent on enriching experiences. It actively undermines future wealth building and financial security.

A bloated car payment consumes income that should go toward retirement savings, emergency funds, and other essential goals, crippling your ability to build long-term wealth and financial security.

Home equity (the market value of your home minus what you owe) can be a source of funds through a Home Equity Loan or Line of Credit (HELOC). However, using this equity to pay off unsecured debt is risky because it converts unsecured debt into secured debt—now your home is on the line if you can't pay.

The main advantages are managing cash flow for necessary larger purchases, taking advantage of sales, and accessing interest-free financing without impacting your credit score (for most soft credit checks). It can also help budget by breaking a large cost into smaller, predictable payments.