The precarious state of overextended personal debt is often a private struggle until it triggers a series of formal and increasingly severe creditor a...

Read More

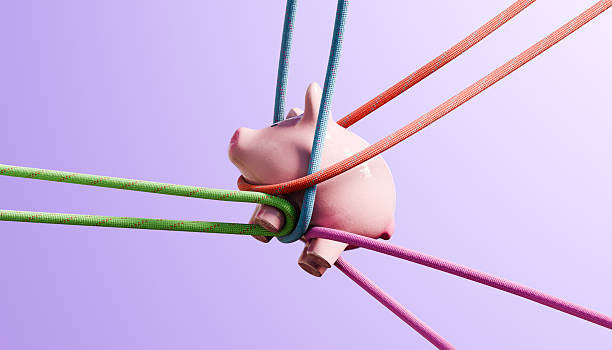

Are you managing your debt? Or is it managing you? If you're stuck in a money quicksand trap, you may not even realize at first that you're in a finan...

Read More

- Start by taking inventory of all your outstanding debts. - Look for ways to maximize your disposable income so you can put more money towards your ...

Read More

The Debt-To-Income Ratio, commonly referred to by its acronym DTI, is a cornerstone of personal financial health, serving as a critical benchmark for ...

Read More

The burden of overextended personal debt is a multifaceted challenge, and while financial discipline is its ultimate remedy, vigilant credit report mo...

Read More

The descent into overextended personal debt often feels like a private struggle, a silent burden of mounting bills and relentless anxiety. However, wh...

Read MoreScrutinizing your three biggest expenses: housing, transportation, and food. Consider getting a roommate, using public transit, and cooking at home more often. Small daily changes (like making coffee at home) add up, but the big-ticket items free up the most cash.

Splaining assets often means each person takes on a higher proportion of debt relative to their now-single income, skewing DTI and making new credit harder to obtain.

A zero-based budget, where every dollar of income is assigned a job (savings, debt, expenses), forces you to be intentional with money. It creates a conscious barrier against frivolous spending increases.

Signs include not knowing total debt amounts, missing payment due dates, having no savings, and repeatedly borrowing to cover everyday expenses.

You can often negotiate to pay a lump sum that is less than the full amount owed to settle the debt. Always get the settlement agreement in writing before sending any payment. Be aware that the forgiven amount may be reported to the IRS as taxable income.