Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and...

Read More

The third decade of life is often portrayed as a period of consolidation: careers advance, families grow, and financial foundations solidify. Yet for ...

Read More

The trajectory of overextended personal debt is a story told in chapters, each defined by the unique pressures and perils of a different decade. It is...

Read More

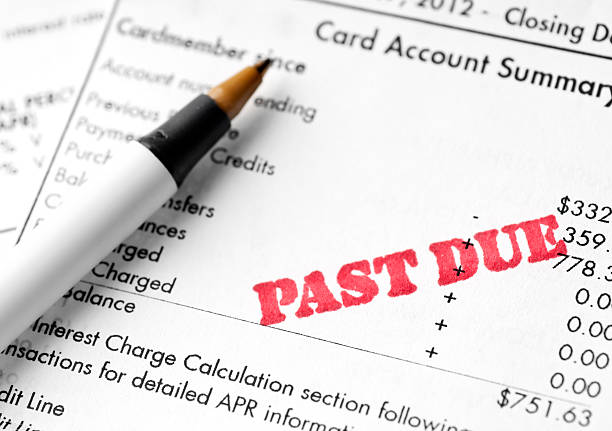

The specter of overextended personal debt looms large in the modern economic landscape, a burden carried by millions. While often rationalized as a te...

Read More

The burden of student loan debt represents a uniquely formidable contributor to the crisis of overextension, particularly for individuals in their pri...

Read More

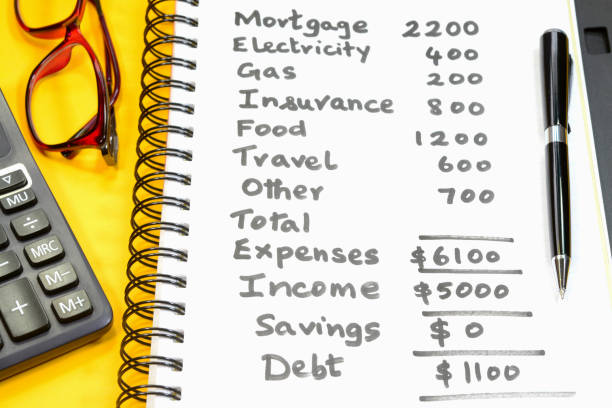

Are you managing your debt? Or is it managing you? If you're stuck in a money quicksand trap, you may not even realize at first that you're in a finan...

Read MoreCredit scoring models, like FICO® and VantageScore®, consider the variety of your credit accounts. A diverse mix demonstrates to lenders that you have experience successfully managing different types of credit responsibilities, which can positively impact your score.

The constant anxiety can lead to sleep disturbances, headaches, muscle tension, high blood pressure, and a weakened immune system. The body's prolonged "fight or flight" response takes a significant toll on physical health.

Money borrowed from family or friends often lacks formal terms, creating emotional strain and relational tension when repayment becomes difficult, adding psychological stress to financial overextension.

Your own financial security must come first. The best way to help your children is to avoid becoming a financial burden on them later. You cannot pour from an empty cup; prioritize your retirement debt.

The goal is to create a large and growing gap between your income and your spending. This gap provides the capital to build wealth, achieve financial independence, and eventually use your money to fund the life you truly want, not just a more expensive version of your current life.