The pursuit of a stable, prosperous life often hinges on two seemingly fundamental pillars: managing personal finances and raising a family. Yet, for ...

Read More

Entering one’s forties is often envisioned as a period of peak financial stability, a time to reap the rewards of two decades of career-building and...

Read More

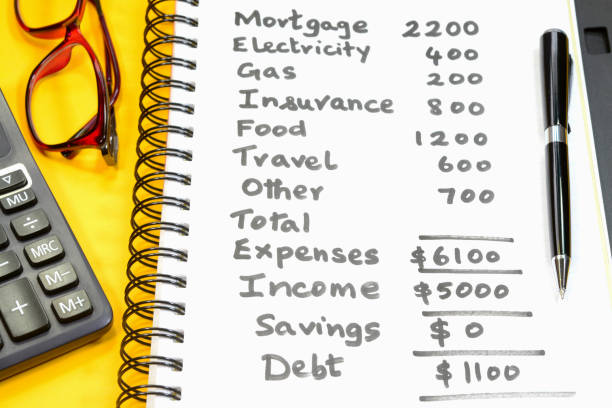

Are you managing your debt? Or is it managing you? If you're stuck in a money quicksand trap, you may not even realize at first that you're in a finan...

Read More

- Start by taking inventory of all your outstanding debts. - Look for ways to maximize your disposable income so you can put more money towards your ...

Read More

Entering one’s twenties often marks the beginning of true financial independence, a period of exciting possibilities juxtaposed with significant eco...

Read More

Navigating the labyrinth of healthcare debt requires a unique blend of financial strategy and systemic understanding, distinct from managing other for...

Read MoreAutomating transfers to savings accounts (for emergencies, goals, and retirement) ensures that saving is prioritized before you have a chance to spend the money. This "pay yourself first" mentality builds financial resilience and reduces the need to borrow for future needs.

It often affects middle-income families who earn too much to qualify for significant government subsidies but not enough to cover the full market rate of childcare without severe financial strain.

Yes, but only after they have sued you and obtained a court judgment. Wage garnishment forces your employer to withhold a portion of your paycheck to send directly to the creditor until the debt is satisfied.

Debt settlement severely damages your credit score, as accounts are reported as "settled" rather than "paid in full." Creditors are not obligated to negotiate, and you may be sued while funds accumulate in a dedicated account. Fees can also be high.

The process can take anywhere from 24 to 48 months, depending on the amount of debt and the speed at which you save funds in the dedicated account. During this entire time, your credit remains damaged and you are vulnerable to collections.